Table of Content

In the U.S., the concept of personal income or salary usually references the before-tax amount, called gross pay. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. However, in the context of personal finance, the more practical figure is after-tax income because it is the figure that is actually disbursed. For instance, a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next month's rent and expenses by using their take-home-paycheck amount. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck.

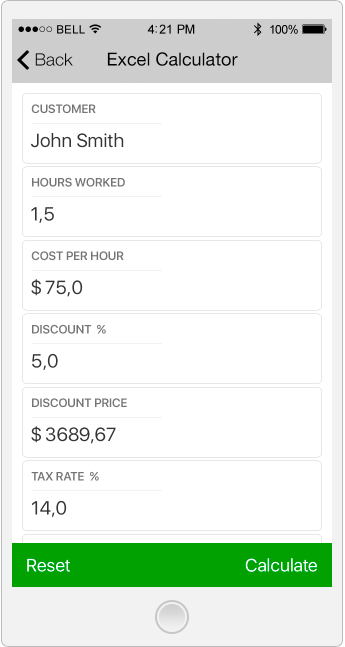

There's no need to fumble over whether to designate an absence as sick or personal leave, or to have to ask the manager to use a vacation day as a sick day. Such jobs can be compensated with a higher salary in the form of hazard pay. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. The unadjusted results ignore the holidays and paid vacation days.

What do you mean by CTC?

Most employers (over 75%) tend to provide vacation days or PTO for many beneficial reasons. As an aside, European countries mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days. Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more.

Check your securities/MF/bonds in the consolidated account statement issued by NSDL/CDSL every month. Needs to review the security of your connection before proceeding. Explore salaries and job trends across careers from every industry. If you’re after an example of exactly what to say in a meeting with your manager about a pay rise, you can use this script. Get a sense of industry standards for roles like yours so you go into salary discussions equipped with a realistic view of what you’re currently being paid and what to aim for.

Calculation for Salary

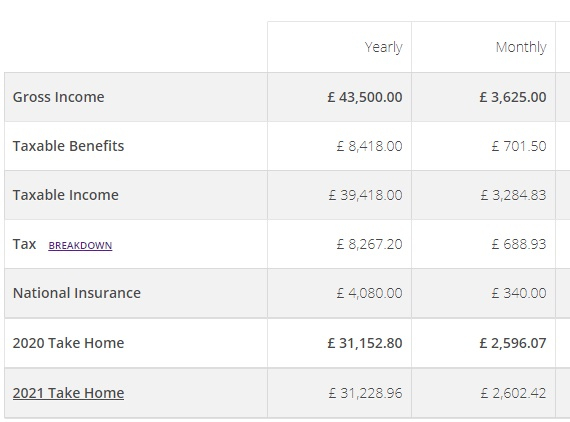

While most employees' salaries have taxes deducted from them on payday, if you're self-employed, you need to file a return manually using the government's Revenue Online Service . There was a shocking discrepancy between the pre-tax and the take-home numbers. Federal and provincial income taxes, Employment Insurance and the Canadian Pension Plan take a significant percentage. In Sydney, median weekly earnings are $1,300 per week, representing a monthly salary of more than $5,600 and yearly earnings of almost $70,000. After deducting taxes, the average single worker in Sydney takes home $53,811 yearly or $4,484 per month.

Knowing what people doing similar roles get paid is a great starting point. It’s usually best to draw on your research and give a preferred salary range when you’re asked for a figure in salary discussions – this leaves you some flexibility to negotiate. If asked, tell your potential employer about your current salary and competing offers. You need to ensure your value as an employee is equal to what you are asking for. Remember, we do our best to make sure our systems are up to date and error free.

Employer contributions

You might agree with your employer to contractually reduce your salary by a certain amount, in exchange for some non-cash benefits. From April 2017, most schemes will only save National Insurance on the value of those benefits. If you know your tax code, enter it here to get a more accurate calculation of the tax you will pay. If you are unsure of your tax code, just leave it blank and the default will be applied. If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation.

If you are unsure of your tax code just leave it blank and the default code will be applied. If you are earning a bonus payment one month, enter the £ value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. The April 2022 values have now been made available to show you the most up-to-date information. Use the Take-Home Salary Calculator to work out just how much more you will have each month. For instance, all else being equal, an office clerk at a public school system will most likely make a lower salary than one at a private hedge fund.

Regardless, this is a good way to approximate what to expect come tax day. You can figure out your take-home salary in just a few clicks using our Canadian salary calculator. It's simple; just select your province, enter your gross salary, choose at what frequency you're being paid , and then press calculate. You'll then see an estimate of your salary after-tax as well as how much you may owe in taxes. Rates remain high in Melbourne, where median weekly earnings top $1,200. That equates to a yearly salary of $62,400 or a monthly rate of $5,200.

Simply increasing relevant knowledge or expertise that pertains to a niche profession or industry can increase salary. This may involve staying up-to-date on current events within the niche by attending relevant conferences or spending leisure time reading on the subject. Location—Different locations will have different supplies and demands for positions, and average salaries in each area will reflect this. Keep in mind that the cost of living should be noted when comparing salaries. In some cases, a job that offers a higher salary may equate to less overall once the cost of living of a different location is accounted for.

It is levied by the Internal Service Revenue in order to raise revenue for the U.S. federal government. While individual income is only one source of revenue for the IRS out of a handful, such as income tax on corporations, payroll tax, and estate tax, it is the largest. In Ireland, which uses the Pay As You Earn system, your employer usually deducts all taxes and contributions from your paychecks directly.

Although continually updated, the information here may differ from what appears on the providers’ sites. The Canada Pension Plan is Canada’s contributory, earnings-based social insurance program. In retirement, this program will provide you with a regular income. It also provides disability benefits and death and survivors benefits.

In contrast to other parts of the CTC, the base wage would stay unchanged. Employers withhold federal income tax from their workers’ pay based on current tax rates and Form W-4, Employee Withholding Certificates. For those who do not use itemized deductions, a standard deduction can be used.

No comments:

Post a Comment